Homeowners Insurance in and around Las Vegas

If walls could talk, Las Vegas, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Everyone knows having fantastic home insurance is essential in case of a tornado, ice storm or windstorm. But homeowners insurance is about more than covering natural disaster damage. One important part of home insurance is its ability to protect you in certain legal situations. If someone hurts themselves in your home, you could be required to pay for the cost of their recovery or their hospital bills. With adequate home coverage, these costs may be covered.

If walls could talk, Las Vegas, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Protect Your Home With Insurance From State Farm

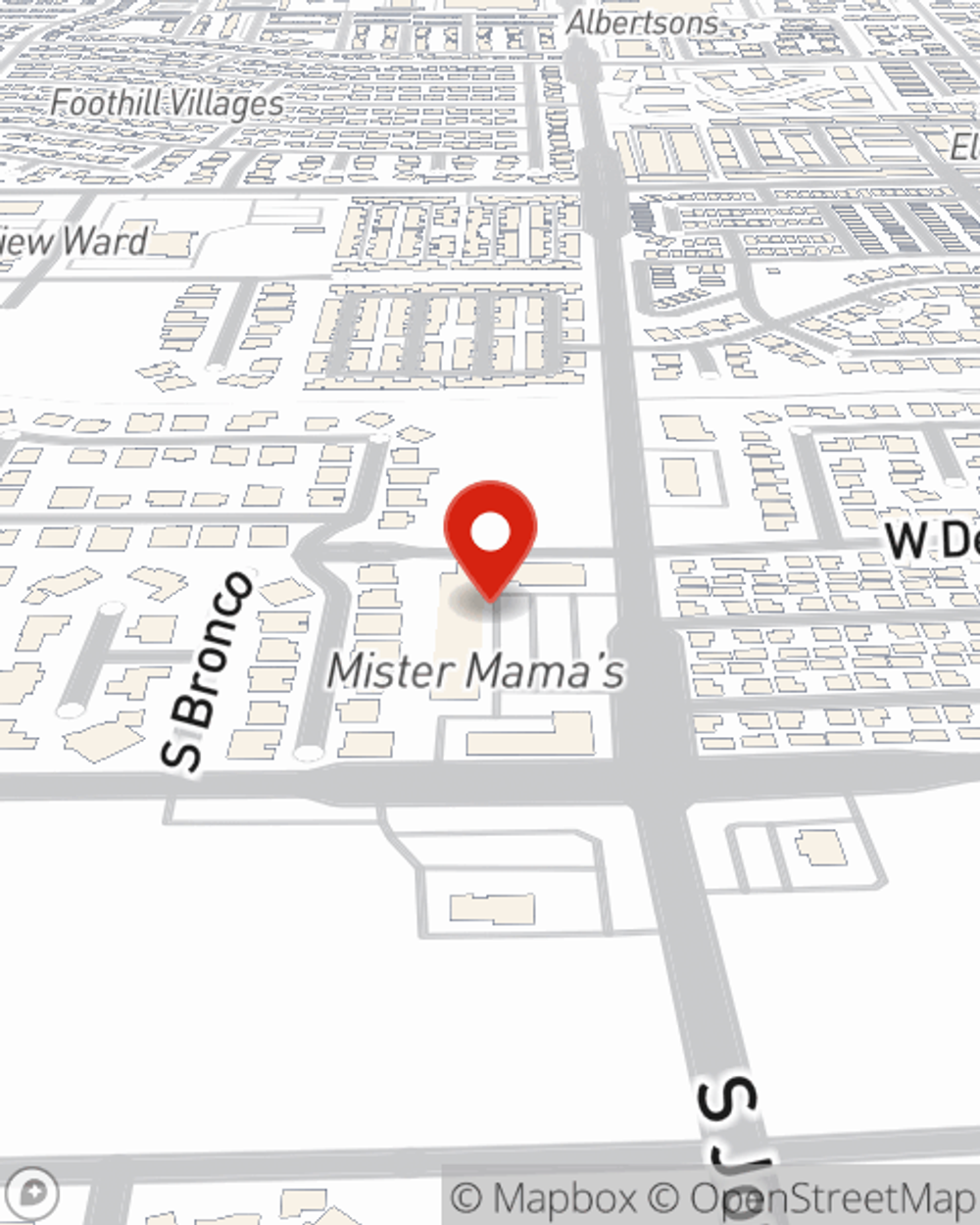

Home coverage with State Farm is the right move. Just ask your neighbors. And reach out to agent Todd Brown for additional assistance with finding a policy that fits your needs.

As a leading provider of home insurance in Las Vegas, NV, State Farm aims to keep your home protected. Call State Farm agent Todd Brown today and see how you can save.

Have More Questions About Homeowners Insurance?

Call Todd at (702) 647-1414 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.